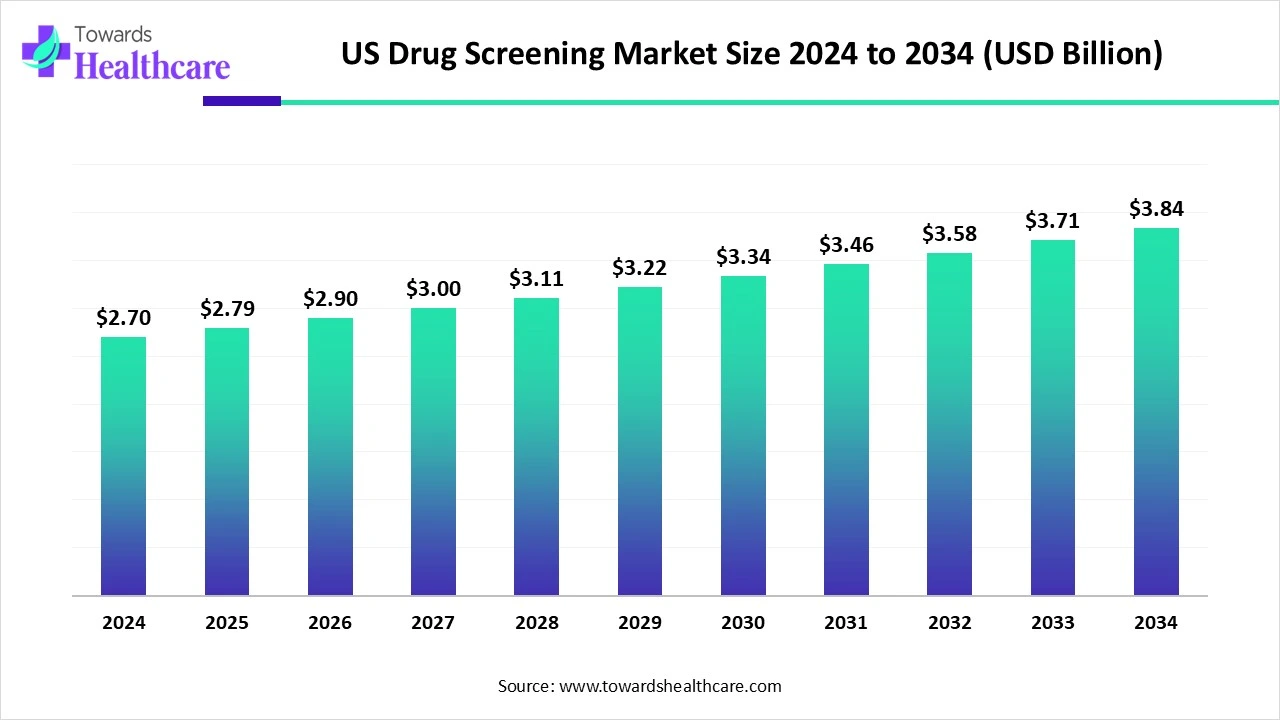

U.S. Drug Screening Market Size to Envision USD 3.84 Billion by 2034

The U.S. drug screening market size is calculated at USD 2.79 billion in 2025 and is expected to reach around USD 3.84 billion by 2034, growing at a CAGR of 3.64% for the forecasted period.

Ottawa, Oct. 20, 2025 (GLOBE NEWSWIRE) -- The U.S. drug screening market size was valued at USD 2.70 billion in 2024 and is predicted to hit around USD 3.84 billion by 2034, rising at a 3.64% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Download the sample of U.S. Drug Screening Market Size, Trends, Segmentations and Competitive Analysis Report: https://www.towardshealthcare.com/download-sample/5839

Key Takeaways

- The U.S. drug screening sector is pushing the market to USD 2.70 billion in 2024.

- Long-term projections show a USD 3.84 billion valuation by 2034.

- Growth is expected at a steady CAGR of 3.64% between 2025 to 2034.

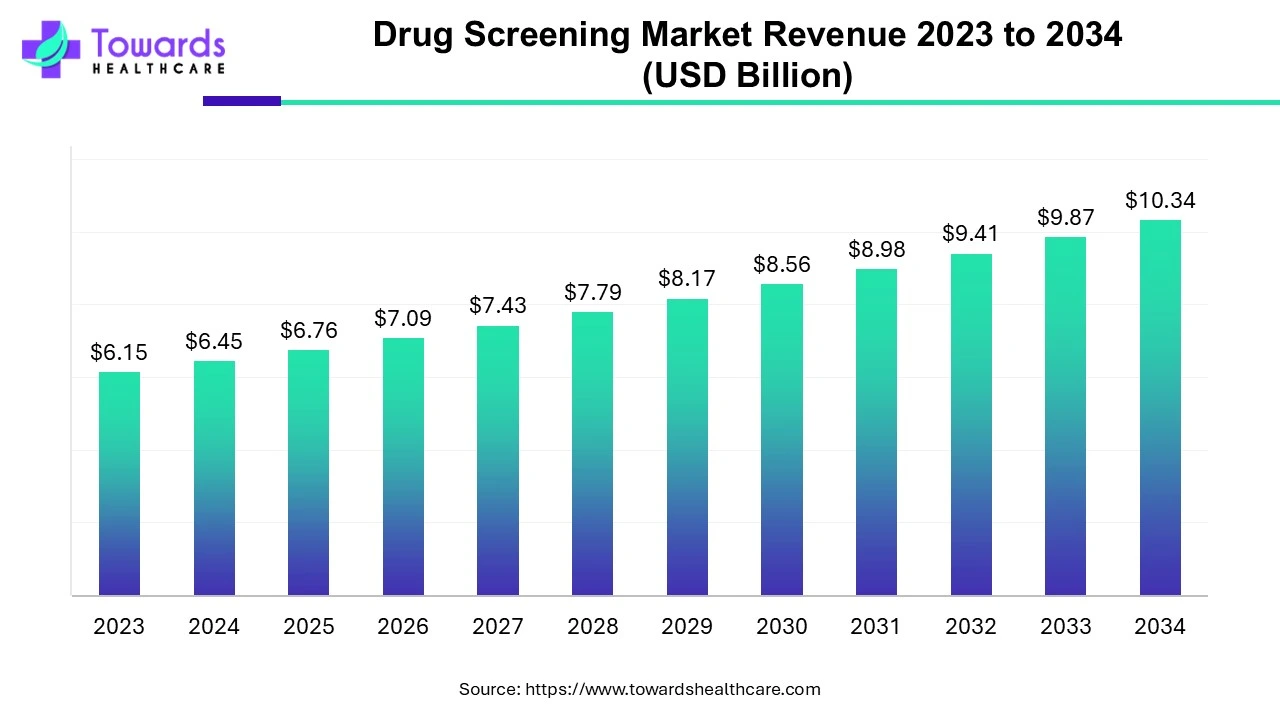

- The global drug screening market is projected to grow from $6.15 billion in 2023 to $10.34 billion by 2034, at a CAGR of 4.84%.

- By region, the South & Midwest U.S. led the market in 2024.

- By region, the West Coast is expected to be the fastest-growing during 2025-2034.

- By product & service, the drug screening services segment accounted for the major share of the market in 2024.

- By product & service, the drug screening products segment is expected to witness the fastest growth in the coming years.

- By sample type, the urine sample segment registered dominance in the U.S. drug screening market in 2024.

- By sample type, the oral fluid (saliva) testing segment is expected to grow rapidly in the studied years.

- By drug class detected, the opioids segment led the market in 2024.

- By drug class detected, the synthetic drugs segment is expected to be the fastest-growing during 2025-2034.

- By end-user, the workplace & employers segment held a dominant share of the market in 2024.

- By end-user, the home care settings/OTC test kits segment is expected to grow at a rapid CAGR in the upcoming years.

- By technology, the chromatography techniques segment was dominant in the market in 2024.

- By technology, the rapid test devices segment is expected to witness the fastest growth during 2025-2034.

What is the U.S. Drug Screening?

The U.S. drug screening market encompasses a process used in the detection of potential drug candidates from a large pool of compounds, or in finding the presence of drugs in a biological sample. A rise in the incidence of substance abuse, stringent government landscapes, and technological advances are fueling the market expansion. Moreover, states like California are stepping away from testing for non-psychoactive cannabis metabolites to avoid discrimination based on past use, putting efforts into tests that indicate current impairment.

Market Scope

| Metric | Details | |

| Market Size in 2025 | USD 2.79 Billion | |

| Projected Market Size in 2034 | USD 3.84 Billion | |

| CAGR (2025 - 2034) | 3.64 | % |

| Market Segmentation | By Product & Service, By Sample Type, By Drug Class Detected, By End User, By Technology | |

| Top Key Players | Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), Abbott Laboratories (Abbott Toxicology), Alere Inc. (now part of Abbott), Thermo Fisher Scientific Inc., Orasure Technologies, Inc., Drägerwerk AG & Co. KGaA (U.S. arm), ForaCare, Inc., Psychemedics Corporation, Premier Biotech, Inc., Omega Laboratories, Inc., American Bio Medica Corporation, Redwood Toxicology Laboratory (Abbott subsidiary), Intoximeters, Inc., Bio-Rad Laboratories, Inc., TruDiagnostic, Millennium Health LLC, Cordant Health Solutions, CRL (Clinical Reference Laboratory), Randox Toxicology (U.S. presence) | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Significant Drivers in the Market?

The U.S. drug screening market is mainly driven by the rising opioid epidemic and misuse of prescription drugs, which fosters the need for screening, especially in healthcare settings and pain management centers. Furthermore, various federal organizations, including the Department of Transportation (DOT), demand routine drug and alcohol testing for employees in safety-sensitive positions, which ultimately encourages market growth.

What are the Major Trends in the U.S. Drug Screening Market?

- In August 2025, Neopharma Technologies Limited collaborated with Zhejiang Orient Gene Biotech Co., Ltd. to combine Neopharma's NEOVAULT software across Orient Gene's range of Drugs of Abuse (DOA) rapid tests under the Healgen brand.

- In June 2025, Intelligent Bio Solutions INBS partnered with SMARTOX, a Texas-based leader in drug and alcohol screening services, to allow non-invasive drug detection using fingerprint sweat and faster results for opiates, cocaine, methamphetamine, and cannabis.

- In January 2025, Northlane Capital Partners invested in United States Drug Testing Laboratories Inc., a forensic toxicology laboratory that tests for alcohol and substance use.

What is the Developing Challenge in the Market?

The continuous arrival of new designer drugs and synthetic substances is are evolving challenge for testing companies, as further development of detection methods that can keep up with emerging drug compositions is a crucial hurdle in the U.S. drug screening market.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis

How did the South & Midwest U.S. Dominate the Market in 2024?

In 2024, the South & Midwest U.S. captured a major share of the market. The possession of robust manufacturing and logistics sectors, with stringent safety protocols, is accelerating the requirement for mandatory drug screening for their employees. Also, this region is bolstering innovations in drug testing technologies, like THC breathalyzers, which are being developed by Cannabix Technologies and Hound Labs to identify recent cannabis use and highlight impaired driving concerns.

What Made the West Coast Grow Significantly in the Market in 2024?

The West Coast is anticipated to expand rapidly in the U.S. drug screening market in the upcoming era. This region is developing state and federal marijuana laws, which are addressing the rising threat of synthetic drugs, specifically fentanyl, and executing new federal regulations that permit oral fluid testing. However, the new federal guidelines are offering standardized procedures for oral fluid specimen collection and testing, as well as updated cutoff levels, mainly for delta-9-THC, the active metabolite of marijuana.

Download the single country market report @ https://www.towardshealthcare.com/checkout/5839

U.S. Drug Screening Market: Recent Notable Efforts

| Congress in April 2025 | Introduced a bill that represents the expansion of random drug testing to comprise "special government employees" in sensitive positions. |

| Biden-Harris administration in 2024 | Secured $45.1 million to accelerate substance use disorder services, including funds for comprehensive opioid recovery centers. |

| The Mainstreaming Addiction Treatment (MAT) Act (2024) | This act removed the federal requirement for a special waiver to prescribe buprenorphine for opioid use disorder (OUD), escalating access to the same. |

Drug Screening Market Companies, Trends and Developments

The global drug screening market was valued at US$ 6.15 billion in 2023 and is projected to reach US$ 10.34 billion by 2034, expanding at a CAGR of 4.84% from 2024 to 2034. This growth is driven by increasing demand for reagents, kits, and devices across hospitals, workplaces, educational institutes, sports events, and law enforcement agencies, emphasizing the critical role of drug screening in ensuring safety, reducing legal liability, and enabling rapid, accurate testing worldwide.

Download the ready to use global insight of Drug Screening Market Size, Trends, Segmentations and Competitive Analysis Report: https://www.towardshealthcare.com/checkout/5332

Segmental Insights

By product & service analysis

How did the Drug Screening Services Segment Lead the Market in 2024?

The drug screening services segment captured the dominating share of the U.S. drug screening market in 2024. It mainly comprises laboratory testing, which facilitates greater precision and reliability. Alongside, on-site (Point-of-Care) testing offers faster results and is feasible to conduct directly at the workplace or other location, simplifying the screening process. Whereas the collection and management provides a suite of services, consisting of handling the chain of custody, electronic documentation (eCCF), random testing pool management, and Medical Review Officer (MRO) services.

On the other hand, the drug screening products segment will expand rapidly during 2025-2034. It encompasses different consumables, like collection cups, test strips, sample collection devices, assay kits, and calibrators, rapid testing devices, instruments, as well as numerous sample types, such as urine samples, saliva samples, hair samples, and breath samples. Also, exploring diverse drug types, particularly Cannabis/Marijuana, opioids, cocaine, amphetamines, and alcohol.

By sample type analysis

Which Sample Type Dominated the U.S. Drug Screening Market in 2024?

The urine sample segment led with a major share of the market in 2024. The expanding benefits, such as ease of collection, affordability, and established reliability, are impacting the adoption. Its collection is non-invasive in nature, along with the use of rapid immunoassay tests, is offer faster results for immediate on-site screening, with laboratory confirmation available for positive tests.

Moreover, the oral fluid (saliva) testing segment is anticipated to expand at a rapid CAGR. Its widespread adoption is accelerating due to its lowered tampering risk and ability to detect recent drug use. For this, a variety of solutions are used, particularly more sensitive test assays and sophisticated analytical methods, including liquid chromatography-tandem mass spectrometry (LC-MS/MS) for confirmation. Also, the growing cases of drug and alcohol abuse in the U.S. workforce and the general population are impacting the overall development.

By drug class detected analysis

What Made the Opioids Segment Dominant in the Market in 2024?

The opioids segment held the biggest revenue share of the U.S. drug screening market in 2024. The accelerating number of opioid-involved overdose deaths, mainly from illicitly manufactured fentanyl, requires wider and more frequent testing for early detection and intervention. Alongside public health initiatives, especially the Helping to End Addiction Long-term (HEAL) Initiative and federal funding, are widely facilitating substance use disorder services.

Although the synthetic drugs segment will register the fastest expansion. A prominent driver is that numerous new psychoactive substances (NPS), like synthetic cannabinoids (Spice/K2) and synthetic cathinones (bath salts), have evolved to evade detection by standard immunoassay screens. The boosting consumption of both illicit and prescription drugs, specifically the potent synthetic opioid fentanyl, is also fueling the innovative tests.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By end-user analysis

Which End-user Led the U.S. Drug Screening Market in 2024?

The workplace & employers segment accounted for the largest share of the market in 2024. The segment is mainly driven by a rise in the need to ensure workplace safety, mainly in high-risk industries like transportation, construction, and manufacturing. Additionally, substance use in the workplace results in reduced productivity, enhanced absenteeism, and raised healthcare expenditures. Whereas with a substantial investment in drug testing, companies are focusing on the prevention of these financial and operational impacts.

However, the home care settings/OTC test kits segment will expand rapidly during 2025-2034. This approach emphasizes on to avoid clinical settings for drug screening to maintain privacy, and skips the need for appointments and travel to clinics or labs, with a more convenient option. Ongoing innovations in diagnostic technology, particularly point-of-care devices and sensor-based technologies, are enhancing the accuracy and reliability of home test kits. And, breakthroughs in sample collection and mobile integration are expanding home testing kits with their easier application and escalated efficiency.

By technology analysis

Which Technology Dominated the U.S. Drug Screening Market in 2024?

In 2024, the chromatography techniques segment held a major share of the market. LC-MS is implemented as a gold-standard technology for its greater sensitivity and specificity in complex biological matrices, including urine, blood, and saliva. Their broader usage in hospitals and laboratories, as well as the application of artificial intelligence and machine learning, are boosting data analysis with optimized accuracy, speed, and minimized human error, mainly for complex results.

Whereas the rapid test devices segment is predicted to expand at a rapid CAGR. They are faster, non-invasive, and easier testing solutions, and increased use in hospitals, pain management centers, and drug treatment is propelling their expansion. The widespread police and other agencies are exploring use of rapid tests for roadside DUI checks and in correctional facilities for faster and reliable results is also impacting their overall adoption.

Browse More Insights of Towards Healthcare:

The global carrier screening market is valued at USD 2.58 billion in 2024, expected to rise to USD 3.09 billion in 2025, and projected to reach approximately USD 15.5 billion by 2034, expanding at a strong CAGR of 19.65% between 2025 and 2034.

The global high content screening market is estimated at USD 1.52 billion in 2024, growing to USD 1.63 billion in 2025, and anticipated to reach nearly USD 3.12 billion by 2034, progressing at a CAGR of 7.54% over the forecast period.

The global breast cancer screening tests market was valued at USD 4.44 billion in 2024, increased to USD 4.75 billion in 2025, and is forecast to attain around USD 8.77 billion by 2034, reflecting a CAGR of 7.04% from 2025 to 2034.

The global cellular health screening market was worth USD 3.37 billion in 2024, grew to USD 3.68 billion in 2025, and is projected to reach approximately USD 8.14 billion by 2034, expanding at a CAGR of 9.24% between 2025 and 2034.

The global newborn screening market is valued at USD 3.44 billion in 2024 and is expected to reach USD 6.46 billion by 2034, growing at a CAGR of 6.5% during the forecast period.

The bone densitometer market is projected to expand from USD 335.42 million in 2025 to USD 489.94 million by 2034, registering a CAGR of 4.3% between 2025 and 2034.

Recent Developments in the U.S. Drug Screening Market

- In October 2025, Alithea Genomics unveiled its MERCURIUS™ Spheroid DRUG-seq, a new, extraction-free RNA sequencing library preparation kit built for 3D spheroid models.

- In March 2025, Astrotech Corporation launched its accelerated TRACER 1000 Narcotics Trace Detector to target the identification of synthetic opiates and new psychoactive substances.

U.S. Drug Screening Market Key Players List

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- Abbott Laboratories (Abbott Toxicology)

- Alere Inc. (now part of Abbott)

- Thermo Fisher Scientific Inc.

- Orasure Technologies, Inc.

- Drägerwerk AG & Co. KGaA (U.S. arm)

- ForaCare, Inc.

- Psychemedics Corporation

- Premier Biotech, Inc.

- Omega Laboratories, Inc.

- American Bio Medica Corporation

- Redwood Toxicology Laboratory (Abbott subsidiary)

- Intoximeters, Inc.

- Bio-Rad Laboratories, Inc.

- TruDiagnostic

- Millennium Health LLC

- Cordant Health Solutions

- CRL (Clinical Reference Laboratory)

- Randox Toxicology (U.S. presence)

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/checkout/5839

Segments Covered in the Report

By Product & Service

- Drug Screening Services

- Laboratory-based services

- On-site testing services

- Drug Screening Products

- Analytical Instruments (e.g., GC-MS, LC-MS/MS)

- Rapid Test Kits & Devices

- Urine dip cards, saliva strips

- Consumables & Reagents

By Sample Type

- Urine Sample Testing

- Standard for DOT and workplace testing

- Oral Fluid (Saliva) Testing

- Hair Follicle Testing

- Breath Testing (for alcohol)

- Blood Testing

- Sweat & Other Emerging Samples

By Drug Class Detected

- Opioids

- Synthetic Drugs

- Cannabinoids

- Amphetamines

- Cocaine

- Benzodiazepines

- Barbiturates

- Alcohol

By End User

- Workplace & Employers

- DOT-compliant transportation, construction, healthcare, manufacturing

- Home Care Settings/OTC Test Kits

- Drug Treatment Centers & Rehab Facilities

- Criminal Justice & Law Enforcement

- Hospitals & Pain Management Clinics

- Educational Institutions

By Technology

- Chromatography Techniques

- Rapid Test Devices

- Immunoassay Analyzers

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5839

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.